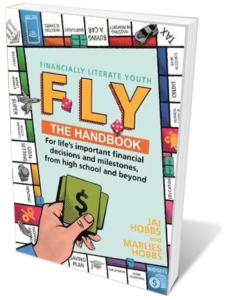

Jai Hobbs is a financial expert with 17 years of experience in the industry. He and his wife Marlies Hobbs are co-authors of FLY – Financially Literate Youth, a handbook for life’s important financial decisions and milestones from high school and beyond. In the interview, Louise Bedford and Jai Hobbs discuss financial literacy and how it is important for parents to positively influence their children’s money scripts. They also talk about the 50:30:20 rule, which is a way to budget and save money.

You’re never too young to learn about money. If we can give our children a rich mindset, they’ll make exceptional traders in the future. In this episode, you will learn:

1. The importance of financial literacy for our youth.

2. The impact of positive vs. negative money scripts on children.

3. The importance of being on the same page financially with your partner.

Plus, you’ll learn about the biggest financial decision you’ll ever make in your life.

Jai’s book covers almost every aspect that we should be teaching our children about money and finances. It’s especially for the ages of high school and beyond and helps them deal with adult life from the point of the milestones they will face –such as how to buy a car, rent a property, and start a business.

It even covers tricky subjects like loaning money to friends and family and the difficulties that can arise when you’ve got different financial goals in comparison to your spouse.

Key Interview Flashpoints:

[00:03:04] – Parents can have a big influence on the money scripts that they pass on to their children. It’s essential to be positive and explain to children why you choose not to buy a new car or go on a holiday.

[00:04:51] – According to research, parents talk to their girls about spending money, earning family finances and checking the balance of their bank accounts, whereas boys are more likely to be taught about savings, borrowing and budgeting. This is a grave mistake and can impact later financial decision-making.

[00:07:10] – Who we marry is one of the biggest financial decisions of our lives. Being on the same page at the start sets us up for the long term so that we can grow in all areas together. The goal of being ‘happy’ sometimes gets thrown around a little bit too much. In the pursuit of individual happiness, fulfillment is a much more worthy goal.

[00:09:25] – If a couple is not on the same page financially, they need to have an open and honest conversation about it. Parents need to give their children enough rope to learn and understand and tread their own path.

[00:13:59] – Jai explains the 50:30:20 rule and why compounding can be your best friend or your worst enemy. Credit reporting in Australia about two years ago became comprehensive credit reporting. Make sure you’re paying your loans on time and credit cards on time. If you’re applying for a loan, use a broker. Traders need to make sure their credit information is up to date.

[00:21:01] – Parents and schools need to work together to teach their children about financial literacy. Parents need to be firm and instil values about basic wants and needs in their children. Get your kids started on budgeting and investing early. Don’t exclude your children from the conversation about money. Let them say what their hopes and dreams are. Show them how they can scaffold their way into that using careful budgeting, using the best parts of money management.

Favourite Quote

“The earlier we can start our kids on that, the better off they’ll be in the long term when the 8th wonder of the world kicks in… compound interest.” – Jai Hobbs

About Jai Hobbs

Jai and Marlies are a husband and wife team, originally from Cairns and now based in Noosa. Jai is a mortgage broker with over 17 years experience and Marlies is a former property development lawyer with a passion for education and creative projects.

Jai and Marlies want to equip young people with a comprehensive reference book that they could keep with them and refer to the relevant sections as and when they needed them. That’s why they wrote FLY – Financially Literate Youth – The Handbook

Jai and Marlies hope this handbook will help guide young people to make informed financial decisions and protect them, where possible, from learning things the hard way and enduring unnecessary financial pain.

Connect with Jai

Website: Financially Literate Youth

About Louise Bedford

About Louise Bedford

Louise is a best-selling author and the founder of www.tradinggame.com.au.

She and her business partner, Chris Tate, have been running their repeat-for-free Mentor Program since the year 2000. They provide simple techniques that you can implement straight away, and valuable resources to enhance your trading so you can maximise your profit potential.

To get in touch with Louise

Facebook: https://www.facebook.com/TradingGame/

Twitter: https://twitter.com/TheTradingGame

LinkedIn: https://au.linkedin.com/in/louise-bedford/

Youtube: https://www.youtube.com/tradinggame

Questions Jai Hobbs Answers in this interview

- Can you define financial literacy and tell us why is it important?

- As parents, we often provide money scripts for kids to follow. These can be what we tell them about money, but also the things we subconsciously convey to our children. How can we influence our children’s money scripts positively?

- You’ve said in the book, who you marry is one of the biggest financial decisions of your life. Tell me more.

- Where do you think couples go wrong when it comes to money?

- Where are people tripping up in their early financial lives?

- There is a section in your book that covers financial hardship. It’s so difficult to see our kids suffer. What should we do to help our children prepare for hard times? When do you think an adult should step in?

- I love the 50/30/20 rule. Can you tell us more about this?

- A lot of people don’t understand the importance of their credit report and how this can impact them. Can you tell us more about this and what we can do to help our youth understand the importance of their credit history? What are some practical tips we can use to make our own credit report look impressive?

- How can schools and parents work together to teach their children about finance?

- What would be the top 3 lessons you wish people would take from your book?

Research to investigate

In interviews with more than 100 school-aged children with an average age of 10 years old, it was found that parents make gender-based distinctions in what they discuss with their children.

Parents talk to their girls about spending money, earning, family finances and checking the balance of their bank accounts. Boys are more likely to be taught by their parents about savings, borrowing and budgeting.

Researcher Lynsey Romo says: “I think parents might just have this latent view that boys are more of the providers.” She goes on to say “There might be some latent cultural assumptions there, for sure.”

Photo by Towfiqu barbhuiya on Unsplash