In this episode, George Fokas, CEO of Fokas Beyond, shares insights into his Covered Calls strategy, offering a unique approach to earning income regardless of market direction.

Discover how writing option contracts allows you to receive upfront income every month.

George breaks down the components of stock options, explaining key terms like strike price, premium, and expiry date. Explore the flexibility of tailoring different combinations of options to create various trading strategies and multiple income streams.

Learn the art of stock protection to hedge against market uncertainties and safeguard your capital.

The episode delves into risk management principles, guiding you on defining your trading capital, determining risk levels, and choosing a suitable position size.

George shares practical rules, such as learning to be wrong, adopting a slow and steady approach, and starting small to learn and earn simultaneously.

George dispels the myth that substantial capital is needed to start making money in the stock market, emphasising that you can get started with a minimal startup of $2,000 – $5,000 USD.

With Fokas Beyond’s step-by-step education process, dedicated mentors, and a proven trading plan, discover how to maximize profits, minimise risk, and manage your money effectively.

Questions we discuss

1. Introduction to the Covered Calls Strategy:

- Can you provide a brief overview of the Covered Calls strategy for our listeners who might be new to this concept?

2. Differentiating Market Makers and Traders:

- You mentioned the distinction between market makers and traders. Could you elaborate on how market makers create contracts and how traders interact with these contracts in the market?

3. Key Components of Stock Options:

- For our audience wanting to delve into stock options, can you break down the essential components such as strike price, premium, and expiry date?

- What are the differences when looking to trade the American options market in comparison to the Australian options market? (Expiry differences and how to handle time differences?)

- How often do you alter your trading strategies? (Rolling up/down changes to your trading strategy vs closing out?).

4. Risk Management in Covered Calls:

- You emphasized the importance of risk management. Can you share specific risk management principles traders can apply when using the Covered Calls strategy?

5. Stock Protection Strategies:

- Options are known to help with stock protection. Could you elaborate on the strategies traders can employ to protect their stocks against market downturns?

6. Calculating and Understanding Risks:

- In risk management, understanding the risks involved is crucial. How do you advise traders to calculate and comprehend the risks associated with the Covered Calls strategy?

7. Starting Small and Scaling Up:

- Your rules include starting small. Can you explain the significance of this approach and how traders can progressively scale up their involvement in the market?

8. Minimum Capital for Income Generation:

- Many listeners might be curious about the financial requirements. What is the minimum startup capital needed to begin generating income with this strategy?

9. Educational Support and Mentorship:

- You’ve emphasised education and mentorship. How does Fokas Beyond support traders in their learning journey, and what role does mentorship play in their success?

About George Fokas

About George Fokas

George Fokas is a self-made millionaire and Wealth Creator who transitioned from working long hours in a job to achieving financial success through the stock market at the age of 28.

Initially introduced to the stock market due to limitations in expanding his property investments, Fokas sought passive income opportunities that allowed him to spend time with loved ones.

Through testing various stock market strategies and developing a positive millionaire mindset, he achieved monthly repeatable income, leading to semi-retirement within four years.

Motivated to share his success and support others in breaking free from the rat race, Fokas Beyond was created to provide a global community with educational resources and coaching in stock market trading.

To get in touch with George

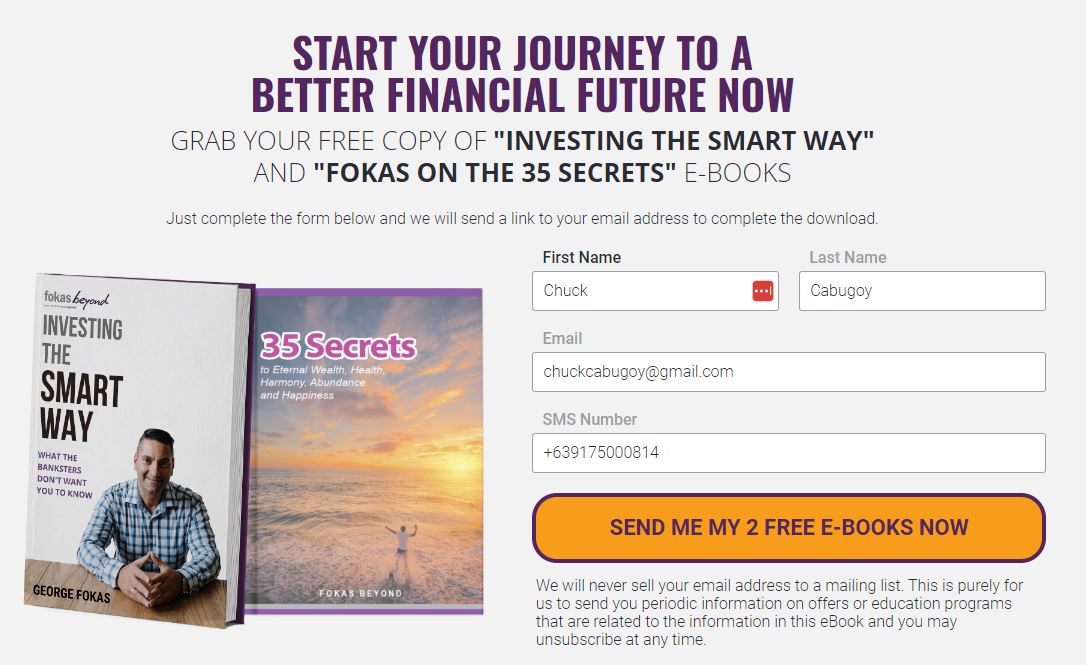

To read George’s “35 Secrets – Investing the Smart Way” book, here’s the link.

It’s located at the bottom of that web page.

About Louise Bedford

About Louise Bedford

Louise Bedford is a highly accomplished and experienced trader, educator, and author, with over 30 years of experience in the financial markets.

She co-founded The Trading Game and is known for her unique approach to teaching trading psychology and market analysis.

Louise has authored several successful trading books, including Trading Secrets, Charting Secrets, and The Secret of Candlestick Charting. She is also a regular contributor to Ausbiz, the Your Trading Edge magazine, and hosts the Master Your Trading Mind Hub at IG Markets Australia.

She and her business partner, Chris Tate, have run their repeat-for-free Mentor Program for the past 24 years. They provide simple techniques that you can implement straight away, and valuable resources to enhance your trading so you can maximise your profit potential.

The Trading Game Mentor Program is a 6-month, repeat-for-free course, that has been running since the Year 2000.

If you’re curious about whether this is your next step, then you need to register for Priority Notification, so you can learn more, and get a heap of free trading resources.

To get in touch with Louise

Facebook: https://www.facebook.com/TradingGame/

X/Twitter: https://twitter.com/TheTradingGame

LinkedIn: https://linkedin.com/in/louise-bedford/

Youtube: https://www.youtube.com/tradinggame

Photo by Adam Nowakowski on Unsplash