Suppose you were planning to purchase a business that had the potential to create an unsurpassed lifestyle for you and your family.

Would you spend some time discovering the critical components necessary for success?

Of course, you would. You’d also work your tail off to develop a business plan that would set you up for the future.

The sharemarket has the potential to change your lifestyle forever. It’s up to you to lay out a road map that will take you from where you are now, to where you want to be. That’s where a trading plan will assist.

Reggie Johnson, a brand new courageous trader, joins Louise Bedford to review his trading plan live on the show. He soon discovers the need for greater specificity in his plan, and how a sound trading system is required to improve his chances for success. This is basically a trading plan horror story… but there is a happy ending.

If you’re interested in trading, but don’t know where to start, this episode is for you.

You’ll learn from Louise Bedford how to create a solid trading plan, including how to manage risk, position size and exit trades. With this knowledge, you can approach the markets with confidence and start achieving consistent profits in the markets.

In this week’s episode featuring Reggie Johnson, Louise Bedford covers:

- How to approach the markets with a solid trading plan

- The importance of being specific when it comes to entry, exit, and position sizing

- The dangers of being too bullish in the stock market

- Why running with scissors (or trading without a sound plan) will hurt you as a trader.

Here’s a breakdown of what we talked about:

[00:02:25] – A trading plan overview.

[00:03:17] – Reggie’s plan to grow as a trader.

[00:04:42] – The trading system – the essential part of your plan.

[00:06:31] – The term archetype.

[00:10:20] – When do you decide to get out.

[00:13:51] – Two things about selling into an uptrend.

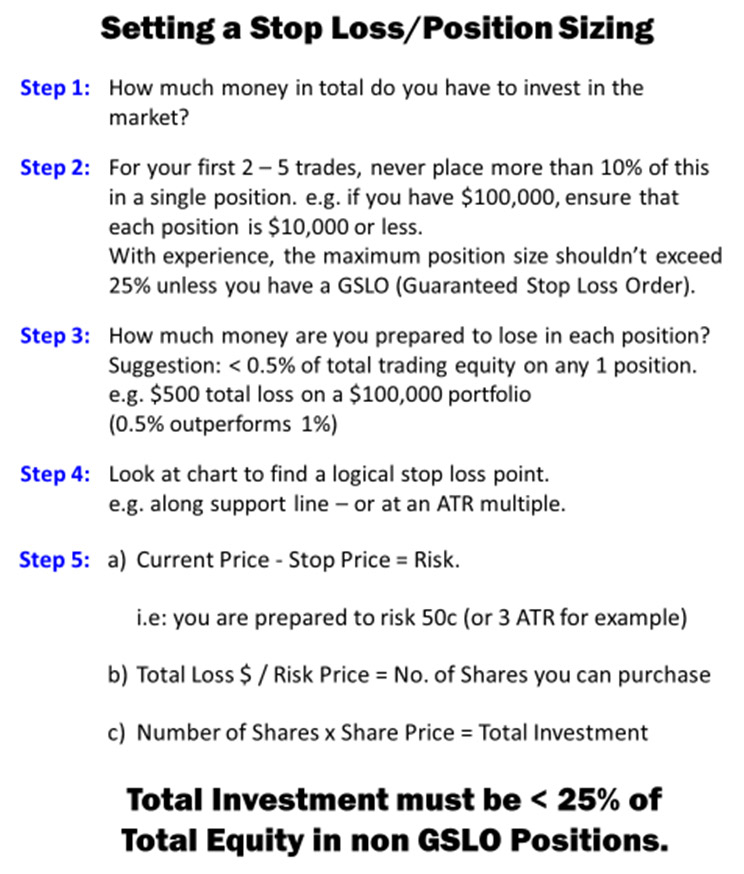

[00:17:38] – The standard stop loss concept.

[00:18:32] – Average true range.

[00:25:13] – Position sizing your position.

[00:32:02] – Get a better macro filter.

Reggie’s trading plan

- Objectives: My objective in trading is to create wealth and financial flexibility in my life.

- Psychology: I feel like my strength is not having too much emotion in my business decisions in general and this includes trading. My biggest weakness is not knowing when to give up on a trade.

- Structure: I currently trade myself and haven’t looked into formalizing a trade structure in this manner. I would have to do more research on this.

- Time: I devote around 3-4 days to trading on average but this fluctuates.

- Expected returns: I would love a 15% – 20% annual return but would like to at least average 10%.

- Which markets: I focus on American Markets such as the Dow, Nasdaq and S&P 500.

- Handling a losing streak: When I have experienced a consistent losing streak I look at the underlying reasons such as macro market conditions, is it a bad time for the sector overall or is it my strategy and make changes accordingly? I’m good at not panicking in these situations.

- Procedures: I don’t have specific daily procedures outside of reading (Wallstreet Journal, NY Times, Seeking Alpha, Motley Fool) and watching shows (CNBC Halftime report, Closing Bell and Fast Money) to keep track of market conditions and news on specific companies. I also check my portfolio daily for movement in my particular positions but I don’t always adjust them.

- Time frame: I’m more of a long-term buy-and-hold trader. Most of the positions I have are months if not around a year old. I trade semi-daily at times and weekly at other times but I seldom enter and exit positions on the same day.

- Percentage risk: I allocate about 3-5% on trades depending on my conviction. I’m open-minded to changing this in the future when warranted.

- Position Sizing: I tend to dip my toe in trades versus diving into the deep end. So I don’t invest a lot of cash immediately. When quarterly reports, news on new products, or C-suite changes come out I look at that specific position and adjust my financial commitment accordingly.

- Stops: This is my biggest weakness and where I feel like I need the most help. I don’t have any problems entering a trade I feel will be profitable but haven’t set stop losses in the past and it’s cost me. This is a work in progress and something I’m determined to get better at with time.

- Entry triggers: I have a few entry triggers. These could be new products in the pipeline, an earnings report that I feel the market is over-punishing a company for, or a company trading far below fair market value for no apparent reason.

- Windfall profit: I reinvest all profits whether large or small.

- Holidays: I review my positions the same at the same rate when I’m on vacation. I’ve even made trades from the beach.

About Reggie Johnson

About Reggie Johnson

Reggie Johnson is a new trader who has been trading since 2020.

He used to do a show on the radio on Star 92.3 in Mississippi named Tech Talk which was about tech info. In 2016 after moving back to Atlanta he wanted to get back into radio but a friend suggested he start a podcast instead. He does a show named Reg in ATL and a sports show named Just the Stats with co-host Eugene Morton which airs weekly.

Reggie’s entry, exit, and position sizing methods are not very fleshed out and need some work. Louise Bedford, senses she has a willing victim, and together they polish his trading plan.

Some key things they work on are making his plan more specific so that another trader could follow it and duplicate his results, and also having a standard stop loss for each trade.

Contact Reggie

Reggie’s podcasts:

Reg in ATL

Just the Stats

Websites: www.reginatl.com and www.justthestat.com

About Louise Bedford

About Louise Bedford

Louise Bedford is a highly accomplished and experienced trader, educator, and author, with over 30 years of experience in the financial markets. She is the co-founder of The Trading Game, and is known for her unique approach to teaching trading psychology and market analysis.

Louise has authored several successful trading books, including Trading Secrets, Charting Secrets, and The Secret of Candlestick Charting. She is also a regular contributor to Ausbiz, the Your Trading Edge magazine, and is the host of the Master Your Trading Mind Hub at IG Markets Australia.

To get in touch with Louise

Facebook: https://www.facebook.com/TradingGame/

Twitter: https://twitter.com/TheTradingGame

LinkedIn: https://au.linkedin.com/in/louise-bedford/

Youtube: https://www.youtube.com/tradinggame