We have a willing victim this week.

A trader called Tiago bravely gave us his trading plan.

So courageous! Watch as Louise Bedford, Don Dawson, and Jordon Mellor… completely RIP IT TO SHREDS, and rebuild it from the ground up.

These three full-time traders review this trading plan live on the show.

Tiago soon discovers the need for greater specificity in his plan, and how a sound trading system is required to improve his chances for success. Watch as these three professionals transform this trading plan into a money-sucking machine.

In this episode, you’ll learn how to create a solid trading plan, including how to manage risk, position size, and exit trades.

With this knowledge, you can approach the markets with confidence and start achieving consistent profits in the markets.

You’ll learn:

- How to approach the markets with a solid trading plan.

- The importance of being specific when it comes to entry, exit, and position sizing, and why an archetypal trade can lead you to profits.

- The dangers of not having appropriate objectives and goals.

- How some simple tweaks can make all the difference.

Handy Definitions

Trading Plan definition:

It is a set of rules and guidelines that a trader or investor uses to make informed decisions about when to enter and exit trades, what positions to take, and how much capital to allocate to each trade.

A well-designed trading plan should include a trader’s goals, risk tolerance, trading style, entry and exit strategies, and money management rules.

Trading System definition:

A trading system is a set of rules and guidelines that a trader follows to enter and exit trades in the financial markets. Plus it tells you how much money to put into each position as well, commonly known as ‘position sizing’.

The Big Idea

Even the famous trader, Jesse Livermore, said “It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!”

Interestingly, research has found most tellingly that being ‘in the action’ is more important than being profitable for the vast majority of traders.

Activity rather than the consequences of that activity is often more important to the trader.

So, some traders actually like the excitement of the markets, more than they focus on whether or not they’re profitable.

Sometimes though, the best action you can take is to pause before you take the next step. Traders often need to take a beat, and sharpen their axe, rather than just plunging forward without thinking about the consequences.

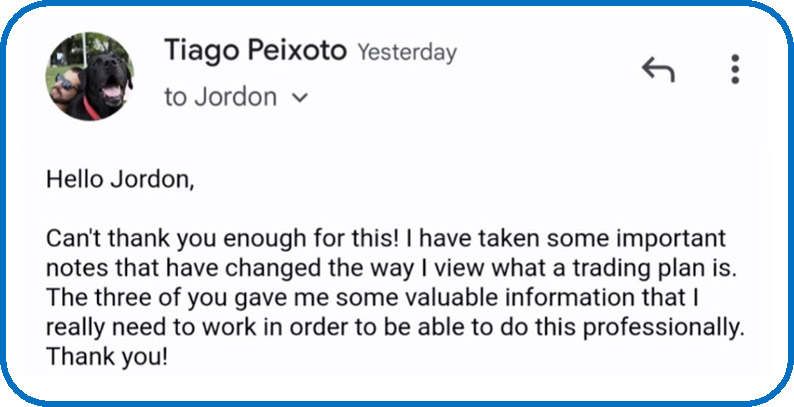

Tiago’s Feedback about the Episode

Tiago was so brave submitting his plan for these three professionals to pick over. Here is his feedback:

It’s so nice to feel appreciated.

About Jordon Mellor

About Jordon Mellor

As Director of TradeDelicious, Jordon is passionate about sharing his knowledge with others. Through his podcast, Traders Of Money, Jordon aims to provide listeners with actionable advice and insights into the world of trading and investing. Jordon’s show is a must-listen for anyone looking to take control of their trading and achieve their financial goals.

Get in touch with Jordon

LinkedIn: https://www.linkedin.com/in/jordon-mellor-749162173/

YouTube: https://www.youtube.com/@tradedelicious

Website: https://tradedelicious.com/

About Don Dawson

About Don Dawson

Don Dawson is a Futures Trader, a Futures Author, and a Futures Market Analyst with more than 35 years of experience who has a strong track record of success.

He is analytical and combines knowledge of market fundamentals with technical analysis. He has authored many articles on commodity markets and has been an instructor for futures classes at an international trading school for 15 years.

Don is also a Futures Market Analyst for Barchart, where he appears on a weekly podcast, and he conducts a bi-weekly webinar on futures trading for OTA-Kansas graduates. He is recognized for his ability to simplify complex market concepts and deliver them with integrity and authenticity.

Get in touch with Don

Barchart: https://www.barchart.com/news/authors/177/don-dawson

LinkedIn: www.linkedin.com/in/dondawson

About Louise Bedford

About Louise Bedford

Louise Bedford is a highly accomplished and experienced trader, educator, and author, with over 30 years of experience in the financial markets.

She is the co-founder of The Trading Game and is known for her unique approach to teaching trading psychology and market analysis.

Louise has authored several successful trading books, including Trading Secrets, Charting Secrets, and The Secret of Candlestick Charting. She is also a regular contributor to Ausbiz, the Your Trading Edge magazine, and is the host of the Master Your Trading Mind Hub at IG Markets Australia.

She and her business partner, Chris Tate, and have been running their repeat-for-free Mentor Program for the past 23 years. They provide simple techniques that you can implement straight away, and valuable resources to enhance your trading so you can maximise your profit potential.

The Trading Game Mentor Program is a 6-month, repeat-for-free course, that has been running since the Year 2000.

If you’re curious about whether this is your next step, then you need to register for Priority Notification, so you can learn more, and get a heap of free trading resources.

To get in touch with Louise

Facebook: https://www.facebook.com/TradingGame/

Twitter: https://twitter.com/TheTradingGame

LinkedIn: https://au.linkedin.com/in/louise-bedford/

Youtube: https://www.youtube.com/tradinggame

You can see Tiago’s plan below

1. Clearly describe your entry triggers, your profit and loss exit triggers and how will you decide position size?

Answer: I trade structure with supply and demand. My entry trigger is an M15 break of structure, inside an H4 supply or demand (depending on structure) zone. My entry is the supply or demand zone on the M15, the TP is the next level of resistance and SL is below the M15 zone. My position size depends on the size of SL, the idea is to keep risk at 2%.

2. Clearly write out your objectives. Are you trading for wealth creation, income, or for fun? Your objectives should be as specific as possible. Exactly what are you hoping to achieve as a trader?

Answer: I am trading because I want to have more free time to do things that really matter to me. My focus is on creating a skill that will allow me to have enough money to create a business and provide jobs to my community. After creating the business, I want to be able to help homeless people and create better conditions for them.

3. What are your psychological strengths and weaknesses in relation to trading? What steps are you taking to overcome your weaknesses and maximize your strengths? Are you teachable? Explain a lesson you learned in life regarding fear, greed, or both. Do you have self-accountability? Explain an example from a life experience.

Answer: My strength is that I am very resilient and it’s very hard for me to quit. My weakness is the ability to self-sabotage and to actually be honest with myself. One example of this is when I was “cheating” while backtesting and I was aware of the fact that it didn’t make any sense to do it but I couldn’t stop myself. I wanted to see certain results and if I missed an entry that worked, I would back in the simulation to get in that trade. So in the end, my backtesting results were not real but somehow I was expecting to see them live. I think this has something to do with the fact that I was watching so many people getting great results with a similar strategy, that it felt like I was failing for not being able to do the same.

a. To overcome my weakness, I am trying to do more real self-reflection. I also had to readjust my expectations regarding results and focus on taking small steps. I am teachable but in regards to trading, I only focus if it’s someone that I trust, which is hard in this industry.

b. I got a lesson from the 2017 crypto boom (as so many people). A friend of mine got me into cryptos early 2017 and we both invested in ETH and BTC. At the time ETH was trading around 40$ and at one point it went lower and I bought more (hard to believe looking back). I didn’t panic and for some reason I really believe in it. Obviously it went up a lot and my investment was making me some very good returns, at the time it was almost a year’s salary. I got greedy and used to the fact that the price always came down before having an impulsive move up and I thought that it would last forever. I was still able to sell in profits but it was almost half of what it could have been, just because I trusted an investment that I barely understood.

c. I believe that I have self-accountability, which is something that I’ve developed during my trading journey. There was a time when I actually thought that the market was to blame for my lack of success and there was something or someone out there manipulating every move to get me.

4. What structure will you trade under e.g. partnership, trust, company etc? If you are uncertain, visit your accountant or tax agent to ensure that you are setting up the best structure for your own individual situation.

Answer: It will probably be under a company but I’m uncertain, so yes, I’ll have to see with an accountant.

5. How much time per day/per week will you devote to trading? How many distractions will you face while you are trading? Is there any way to overcome these distractions?

Answer: Currently I’m trying to do this full-time, so I don’t have any other distractions.

6. What size of percentage returns are you expecting per annum? This will have an impact on your choice of markets to trade.

Answer: I had to readjust my expectations recently and I’m trying to not even have any. But from my recent backtesting results, I would say something between 20 and 40%.

7. How much “risk” capital do you have to devote to your trading system? Does your trading capital size dictate your trading style (day or swing trade)? Will you use only one trading system, or several?

Answer: At the moment I’m willing to devote around 10k to my trading strategy, as I think I need to get at least 6 months of results in order to increase the size. I also have the goal to trade with a prop firm.

a. The idea is to day trade, with one system. After getting some real experience, I will probably try to sample size another system or pair.

8. Which markets will you focus on e.g. futures, managed funds, equities, CFDs, or options? Will you trade Australian shares, or overseas markets? How will you allocate capital between these areas?

Answer: I only trade EURUSD. I’m also doing some forward testing with GBPJPY but it’s something that I’ll be working on for at least 6 months before really considering adding to my live trading.

9. If you experience a consecutive string of losses, how will you react? What percentage of your initial capital can you tolerate losing before you will stop trading temporarily/permanently? What procedure will you follow to correct these losses?

Answer: I have experienced a string of losses before and my reaction is always to reconsider the system. Which didn’t make any sense because I was trading a low win rate strategy on the M1, so it was more than expected that I would experience a lot of those. I got trapped in that loop for quite some time. I’ve recently adapted my system to increase the win rate. So my expectation is to keep the string of losses lower. From now on, I would say that if I have 15 losses in a row and after analyzing all of them, I come to the conclusion that they were all valid, I would probably stop trading the system and look for some type of improvement.

10. What procedures will you follow on a day-to-day, week-to-week basis etc. to search for opportunities, monitor your existing positions and review your performance? Is your life structured to allow you to follow a routine? What routines do you have now that will help you become a good trader?

Answer: Every week I review my performance and study if there were any opportunities that I missed and if the trades that I took were valid or not. I do the same process at the end of the month, quarter and year. I also write down the lessons that I learned and the things that I’ve done to improve.

a. I will describe the general idea of my routine and I should mention that I keep track of it, to understand if I’m deviating from it or not. I wake up at 06:30, do my morning forecast and set alerts on TV. If there’s no opportunities in the near future, I’ll go out for a walk with my dog. If when I come back there’s still nothing close, I’ll do something trading related, like backtesting or reading. After that I’ll eat, wait for the New York opening and then it depends on what the market is doing but if I don’t have an opportunity, I’ll just go do some type of workout (gym, squash, climbing, etc). At the end of the day, I’ll look for some case studies, do my evening forecast and I’ll also plan the next day. This is the core idea, it depends if I have something in the middle or not but 95% of the time my focus is the market.

11. Over what time frame will you trade, e.g. intra-day, daily, weekly? How long do you envisage holding each position? If you are already trading, how long is your average hold time? Does this fit in with your psychological profile and goals?

Answer: My entry time frame is the M15 and my average hold time is 2 hours. This is based on recent backtesting and a few trades that I took with this system recently. This does fit with my psychological profile and it was the reason why I changed. Like I said, I used to take entries on the M1 with a tight SL and I kept trying to trade like that for a very long time. Recently I have come to the conclusion that it is not for me, at least for now. Maybe with more live experience I’ll be able to do it. The difference is that sometimes I would take, for example, 2Ls inside a valid M15 POI but I needed to have the strength to take the second and sometimes even the third or fourth position. Otherwise, I would “waste” a valid POI just to have a smaller SL. Now I would rather have a larger SL and be in that position for a while, as it doesn’t feel like it was a waste of capital even if it goes to my SL because I’m getting one loss for one idea that was wrong, instead of 3 or 4.

12. What percentage of your capital are you willing to risk on each trade? When, if ever, will you alter this percentage?

Answer: I’m willing to risk 2% and it’s fixed. If my account grows to a point where 1% is significant for me, I’ll decrease it.

13. How will you keep a record of your transactions? What statistics will you keep to determine whether you’ve been a success? What key risk management metrics will you use to maintain and manage your portfolio?

Answer: I keep track of my transactions using Notion. I have a spreadsheet on it to keep track of my entry models’ win rate, what confluences were present in each trade, what were the swing trends, SL size, results measured in RR, time of the day and potential of the trade.

14. How will you measure your performance? How often will you review your existing portfolio? How will you know when you have done well or poorly? When trading poorly, how will you know if it’s your trading plan or you that needs work?

Answer: I’ll measure my performance based on RR. At the end of each month I’ll study my results and see if there was a gap between what my trading plan provided and what I actually got from it. If there’s a significant difference, I’ll know that I am the one that needs work. To consider changing the trading plan, I need to wait for the end of the quarter and then do the same process.

15. How will you handle a windfall profit?

Answer: That’s very hard to happen because I always have TPs set, so the profits that I take from each trade are expected.

16. What will you do with your open positions when you go on holidays?

Answer: I never have an open position for weekends or holidays.

17. How do you plan to deduct money from your trading account e.g. salary? When will this be conducted? How will this affect your position sizing etc? Will trading profits be supplemental or a primary income for you? How will you fund medical, holiday, and emergency expenses as a full-time trader?

Answer: I never really thought about that but I want trading to be my primary source of income. I’m also beginning to work on a different business (something that I haven’t mentioned yet because it’s still in early stages) but I still expect to make more from trading. I’ll probably pay myself at the end of each year.

Photo by Scott Graham on Unsplash