Robert Mennella is a seasoned Wall Street professional with over 30 years of experience.

Robert shares his fascinating journey from junior stockbroker to whistleblower at JP Morgan.

Listeners will gain valuable insights into the pivotal role that mindset and strategy play in achieving trading success.

Robert dives deep into the concept of creating a trading edge, emphasising the importance of self-control in a trader’s journey.

He discusses why traders should avoid getting overly attached to specific stocks. He also highlights the habits that distinguish exceptional traders from the rest.

With practical tips and anecdotes from his extensive career, Robert equips traders with the tools they need to elevate their trading game.

This episode is not just about trading techniques; it’s a masterclass in understanding the psychological factors that influence trading decisions.

Robert uncovers the unexpected pitfalls that traders often encounter and shares strategies for overcoming setbacks.

Tune in to discover how to maintain focus, develop critical habits, and ultimately, achieve greater success in your trading endeavours.

Key Topics

Developing a Trading Edge: Learn practical strategies to create a competitive advantage in trading, enabling you to make informed decisions and enhance your overall trading performance.

Cultivating Self-Control and Purpose: Discover how mastering self-control and understanding your purpose as a trader can lead to more disciplined trading practices and reduce emotional decision-making.

Overcoming Common Trading Pitfalls: Gain insights into the unexpected challenges traders face and effective strategies to navigate setbacks, helping you to maintain focus and loyalty to your trading plan.

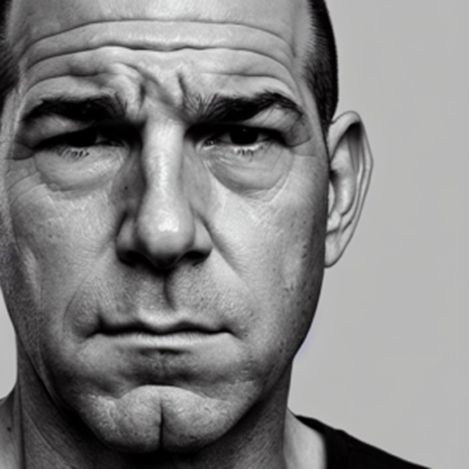

About Robert Mennella

About Robert Mennella

Robert Mennella, the mind behind Heavily Redacted – A JP Morgan Whistleblower’s Journey, had an extensive three-decade journey on Wall Street.

Commencing as a junior stockbroker in 1989, he steadily climbed the career ladder. Robert was fueled by a growing fascination with the pivotal question: “Can you predict the future using charts?”

In this conversation, Louise delves into Robert’s insights on the distinguishing factors that elevate great traders to exceptional status.

Robert emphasises the significance of creating a unique edge and steering clear of undue attachment to specific stocks.

Notably, Robert leverages candlestick charting as a cornerstone of his trading system. He attributes his valuable edge in the dynamic world of trading to candlestick charting.

To get in touch with Robert

LinkedIn: linkedin.com/in/

Website: http://www.patreon.

About Louise Bedford

About Louise Bedford

Louise Bedford has traded, taught, and written extensively about the financial markets for over 30 years. In this time, she has built a reputation as a highly accomplished and experienced trader, educator, and author.

She co-founded The Trading Game and has gained recognition for her unique approach to teaching trading psychology and market analysis.

Louise has authored several successful trading books. In particular, her titles include Trading Secrets, Charting Secrets, The Secret of Candlestick Charting, and Investing Psychology Secrets.

Louise runs her hugely popular, repeat-for-free Mentor Program Pro online course. Through this course, she shows you how to automate your trading so you can retire early and get on with your life.

To get in touch with Louise

Facebook: https://www.facebook.com/TradingGame/

Twitter: https://twitter.com/TheTradingGame

LinkedIn: https://linkedin.com/in/louise-bedford/

Youtube: https://www.youtube.com/tradinggame

TikTok: https://www.tiktok.com/@tradinggame.com.au

Instagram: https://www.instagram.com/tradinggame.com.au/

Photo by Aditya Vyas on Unsplash